40 alabama state retirement

Home Page - SPD - State of Alabama Personnel Department State of Alabama website (opens in new window) State Employees' Insurance Board(SEIB) (opens in new window) State Retirement Systems(RSA) (opens in new window) Division of Risk Management (opens in new window) Alabama Career Center (opens in new window) Department of Labor (opens in new window) Employees' PerksCard Website (opens in new window) Pay Plan (Salary Schedule) - SPD - State of Alabama ... Class: 10876 Senior Retirement Counselor Grade: 74 Act# 2005-316 REQUIRES STATE EMPLOYEES TO BE PAID AT A SEMI MONTHLY RATE. THE COMPARISON TABLE IS PROVIDED FOR INFORMATIONAL PURPOSES ONLY.

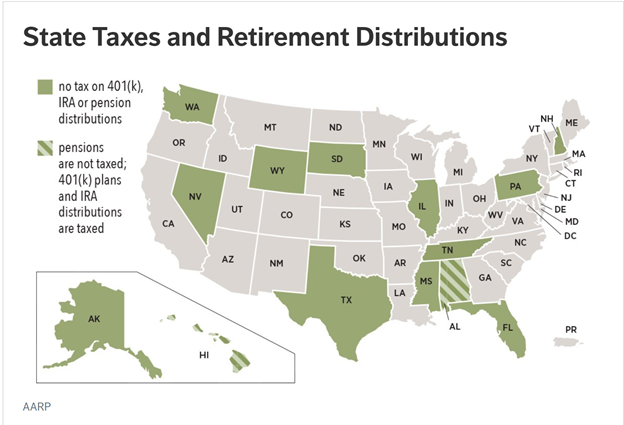

Income Exempt from Alabama Income Taxation – Alabama ... State of Alabama Judicial Retirement System benefits. Military retirement pay. Tennessee Valley Authority Pension System benefits. United States Government Retirement Fund benefits. Payments from a Defined Benefit Retirement Plan in accordance with IRC 414(j). Federal Railroad Retirement benefits. Federal Social Security benefits. State income tax refunds. …

Alabama state retirement

RSA Retirement Benefit Estimate Calculator RSA Retirement Benefit Calculator Step 1. Enter at least three (3) letters of the name of the agency or school system by whom you are employed. For example, TUSC will select all employers with TUSC anywhere in the name. (NOTE: Cities and Towns are referenced by name only; i.e., CITY OF HOOVER is shown as HOOVER.) Alabama Administrative Code Alabama Legislative Services Agency Alabama State house 11 South Union Street Montgomery, AL 36130 P: (334)261-0600 STATE OF ALABAMA ETHICS COMMISSION Feb 24, 2022 · STATE OF ALABAMA ETHICS COMMISSION Mailing Address Street Address P.O. Box 4840 Montgomery, AL RSA Union 100 North Union Street 36103-4840 Suite 104 Montgomery, AL 36104 Thomas B. Albritton Director Telephone: (334) 242-2997 Fax: (334) 242-0248 Web Site: 1 of 63

Alabama state retirement. Retired State Employee List - SPD - State of Alabama ... State of Alabama website (opens in new window) State Employees' Insurance Board(SEIB) (opens in new window) State Retirement Systems(RSA) (opens in new window) Division of Risk Management (opens in new window) Alabama Career Center (opens in new window) ... Please choose Retired State Employee with a General or Law Enforcement Option. * Name: Teachers' Retirement System | The Retirement Systems of ... TEACHERS' RETIREMENT SYSTEM. Since 1939, The Teachers' Retirement System (TRS) has provided benefits to qualified members employed by state-supported educational institutions, including public employees of K-12 school systems, two-year Community Colleges, four-year higher education institutions, and state education agencies. Our goal is to provide exceptional … Job Opportunities - SPD - State of Alabama Personnel ... The hourly, conditional Retired State Employee classification is used by various agencies to reemploy individuals who have retired from the State of Alabama. To be eligible for this classification, you must be a State retiree currently receiving retirement benefits from the Employees' Retirement System, the Teachers' Retirement System, or ... Is My Alabama State Retirement Taxable? - Ozark Ronald. Social Security income in Alabama is exempt fully from taxes from the state. The Alabama revenue will not be increased due to any additional taxes paid by you, even if you make more or less money in retirement. If a retired individual receives a pension benefits, the income is usually subject to federal tax. Table of contents.

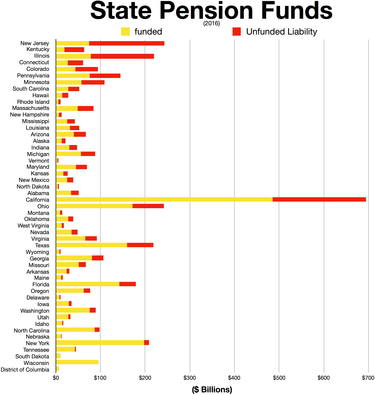

Benefits of State Employment - SPD - State of Alabama ... The State of Alabama and its agencies reserve the right, at its discretion, to alter any or all plans and benefits described in this summary for any reason at any time with or without notice Retirement Alabama - NASRA The Retirement System of Alabama administers pension and other benefits to most public employees in Alabama. The system consists of the Teachers' Retirement System and the Employees' Retirement System, which includes state employees, state police officers, and employees of political subdivisions that have elected to participate.RSA also administers the Judicial Retirement Fund. Alabama Department of Veterans Affairs The Alabama State Veterans Memorial Cemetery is located in Spanish Fort. READ MORE. AlaVetNet Connecting Veterans to Resources Just for Them! READ MORE. FAQ Frequently Asked Questions READ MORE. About Us. Commissioner's Message; State Board of Veterans Affairs; ADVA Mission; Employees Only; Alabama. Alabama.gov ; Office of the Governor; … How To Calculate Alabama State Retirement? - Ozark Is Alabama A Good State To Retire To? Ranking sixth among states in the U.S. when it comes to retirement security is Alabama. Although there is a mild winter, a wide choice of beaches, and a vibrant golf season, Alabama's per capita income is 13% lower than national averages.

The Retirement Systems of Alabama - RSA al The Retirement Systems of Alabama We are the safe keepers of pensions for thousands of Alabamians and we take our jobs seriously. It is our goal to seek and secure the best investments and services for our membership, and to ensure that we do everything possible to help our members prepare for and enjoy a successful retirement. Taxes in Alabama to Iowa - Retirement Living Retirement Income Taxes: Alabama does not tax any retirement income. Retired Military Pay: No tax. Survivor benefits not taxed. Property Taxes. Alabama’s effective property tax ranks among the lowest in the nation at 0.42%. Homeowners pay $854 on a $205,000 home. Each county may charge an additional property tax. error.headingTitle - Empower Retirement {{accuCustomization.metaTags.description}} {{("logon." + authentication.errorMessage) | translate:authentication.errorMessageParams}} {{"logon.logonTitle" | translate}} ALABAMA STATE PERSONNEL BOARD ALABAMA STATE PERSONNEL BOARD. ADMINISTRATIVE CODE . 300 Folsom Administrative Building. 64 No. Union Street. Montgomery, Alabama …

What Are Alabama Tax Laws for Retirement and Social Security ... Mar 26, 2021 · Alabama does recognize Roth IRA and Roth 401(k) plan distributions as tax-free, matching the federal treatment of these retirement accounts. (For more on IRAs and how they work, head on over to ...

Is Alabama a Good State to Retire In? | Acts Retirement 05/04/2020 · Are you still wondering if Alabama is a good state to retire in? Here are five reasons why the Heart of Dixie should be a top of your retirement destination list! 1. Tax-Friendly and Affordable According to Kiplinger.com, Alabama is the “ most tax-friendly ” state in the country. Social security benefits, payments from pension plans, and ...

Alabama Retirement System | Pension Info, Taxes, Financial ... 28/11/2018 · Alabama does not charge income tax on pensions or money from any of the Alabama retirement system accounts. The state taxes income from other retirement accounts as regular income. That means you will pay the state’s regular income tax rates, which range from 2% to 5%. You can learn more about retiring in the state with this guide to Alabama …

Home Page - Alabama Dept of Corrections Hiring Correctional Officers State Wide. Jobs come and go, but careers last. Explore your rewarding career opportunities with the Alabama Department of Corrections. The ADOC is hiring Correctional Officers with professionalism, integrity, and accountability. You'll be rewarded with excellent pay and a long list of health and retirement benefits.

What Retirement Income Is Taxed By State Of Alabama? - Ozark The State of Alabama has many retirement packages that are tax-friendly. In the United States, there is no tax on Social Security income. Taxes on retirement account withdrawals are fully imposed. In Oklahoma, wages are taxed at normal rates, and your state tax rate is 5 percent. 90%. Table of contents.

Retirement Program - Alabama State University Retirement Eligibility. 25 years of service at any age. 10 years of service at the age of 60. No 25 year retirement. 10 years of service at the age of 62 (56 for FLC Employees) Average Final Salary. Average of the highest three years out of the last ten years. Average of the highest five years out of the last ten years.

Testing - SPD - State of Alabama Personnel Department State of Alabama website (opens in new window) State Employees' Insurance Board(SEIB) (opens in new window) State Retirement Systems(RSA) (opens in new window) Division of Risk Management (opens in new window) Alabama Career Center (opens in new window) Department of Labor (opens in new window) Employees' PerksCard Website (opens in new window)

State and Local Consumer Agencies in Alabama | USAGov Alabama State Banking Department, Montgomery, AL Website: State Banking Department ; Phone Number: 334-242-3452. Toll Free: 1-866-465-2279. Insurance Regulators. Each state has its own laws and regulations for each type of insurance. The officials listed in this section enforce these laws. Many of these offices can also provide you with ...

STATE OF ALABAMA ETHICS COMMISSION Feb 24, 2022 · STATE OF ALABAMA ETHICS COMMISSION Mailing Address Street Address P.O. Box 4840 Montgomery, AL RSA Union 100 North Union Street 36103-4840 Suite 104 Montgomery, AL 36104 Thomas B. Albritton Director Telephone: (334) 242-2997 Fax: (334) 242-0248 Web Site: 1 of 63

Alabama Administrative Code Alabama Legislative Services Agency Alabama State house 11 South Union Street Montgomery, AL 36130 P: (334)261-0600

RSA Retirement Benefit Estimate Calculator RSA Retirement Benefit Calculator Step 1. Enter at least three (3) letters of the name of the agency or school system by whom you are employed. For example, TUSC will select all employers with TUSC anywhere in the name. (NOTE: Cities and Towns are referenced by name only; i.e., CITY OF HOOVER is shown as HOOVER.)

/cloudfront-us-east-1.images.arcpublishing.com/gray/7RYHROW3LBFN3AGM7CBEAET4AQ.jpg)

0 Response to "40 alabama state retirement"

Post a Comment