43 generally accepted accounting principles

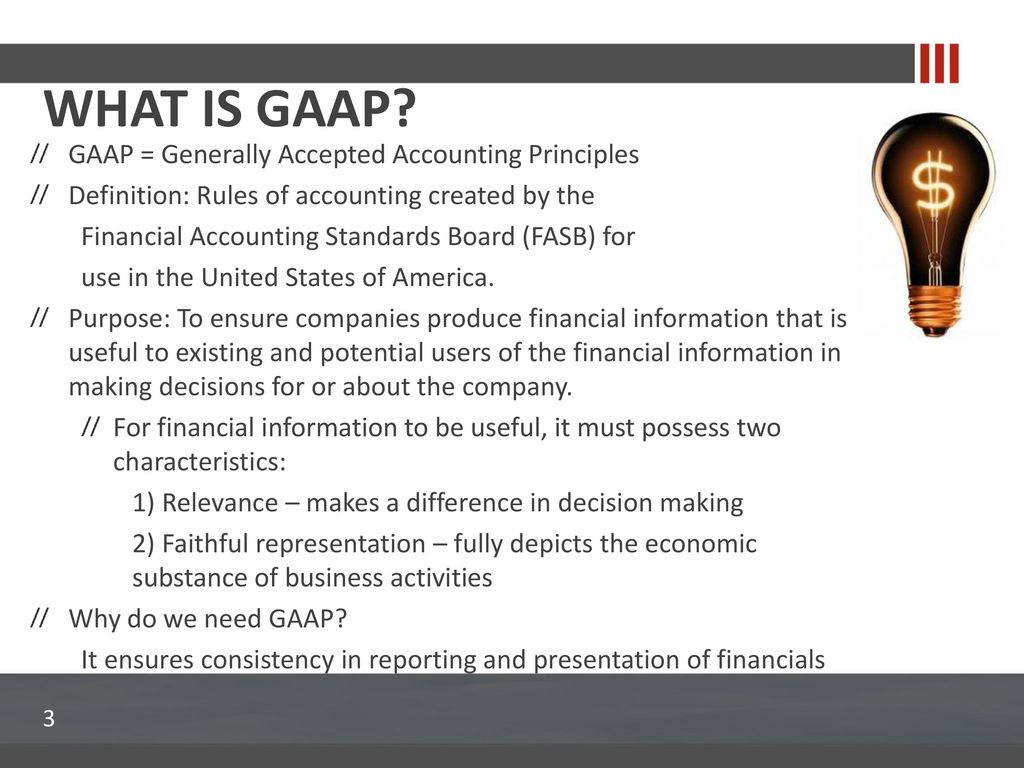

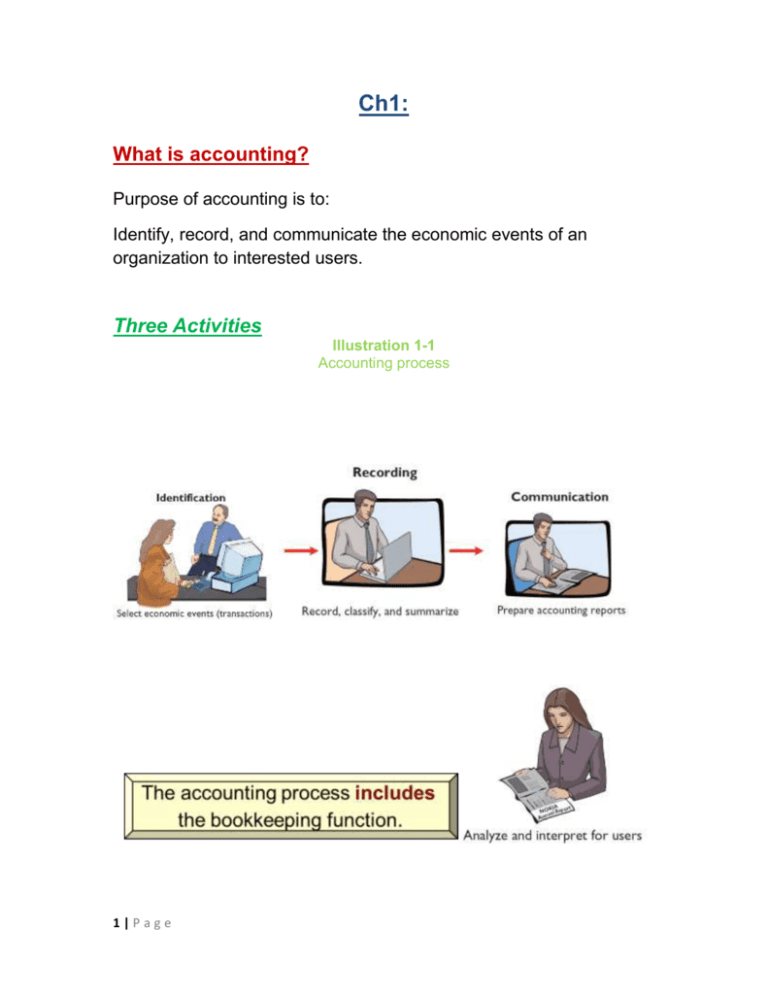

Introduction to GAAP (Generally Accepted Accounting Principles) This video discusses Generally Accepted Accounting Principles (GAAP). GAAP refers to the common set of rules companies must follow when preparing financial... PDF Ads by Google | Generally Accepted Accounting Principles (GAAP) Generally accepted accounting principles, or GAAP as they are more commonly known, are rules for the preparation of financial statements. Every publicly traded company must release their financial statements each year. These statements are used by investors...

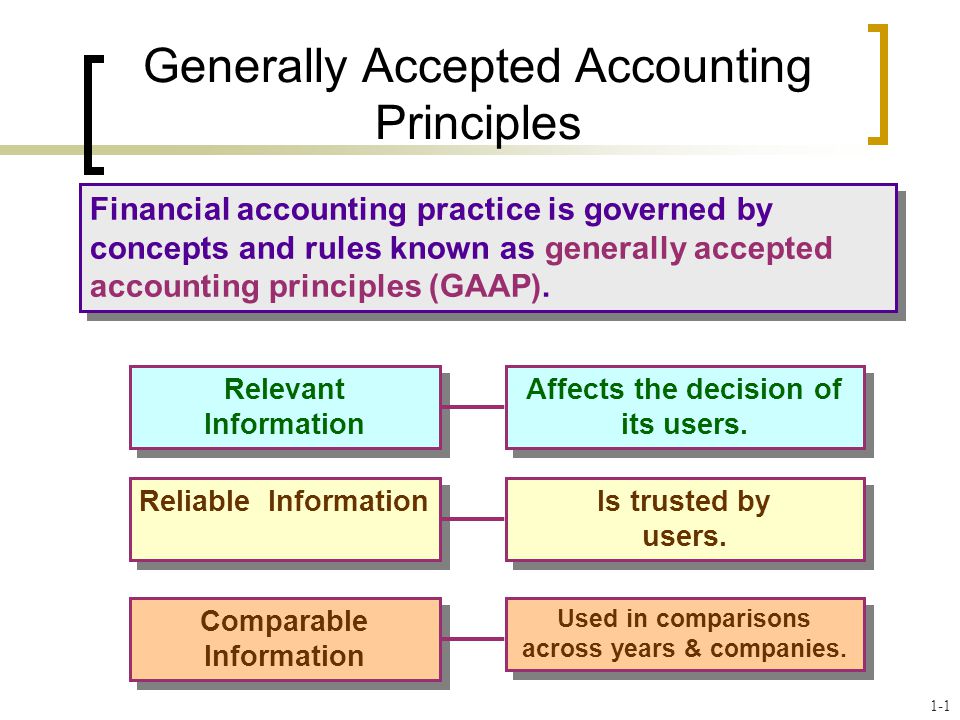

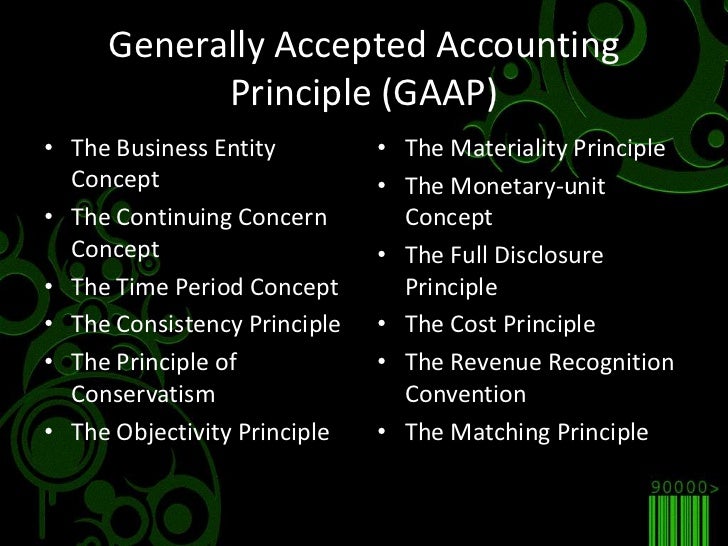

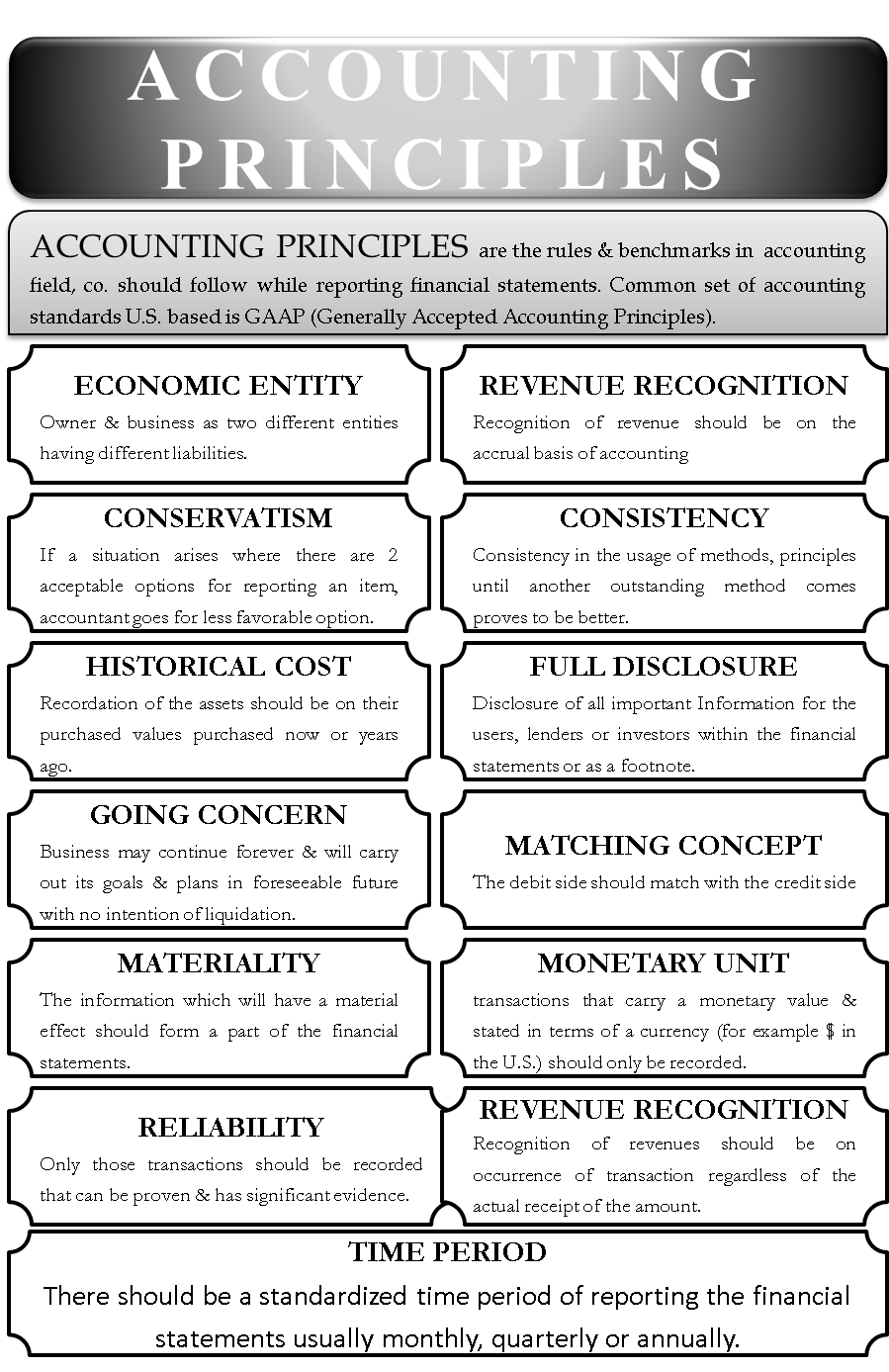

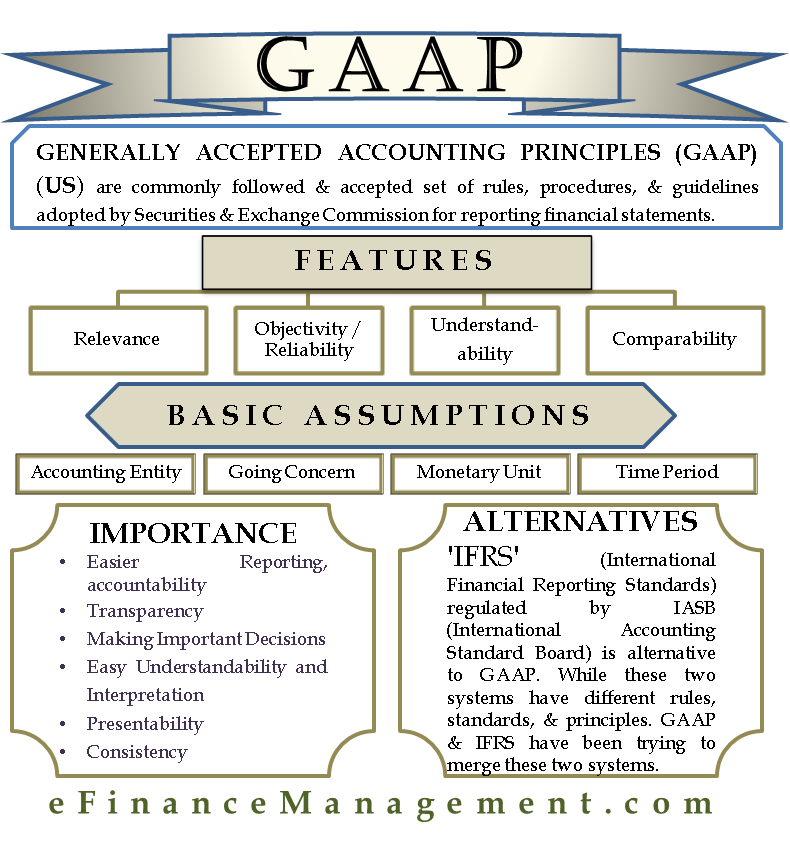

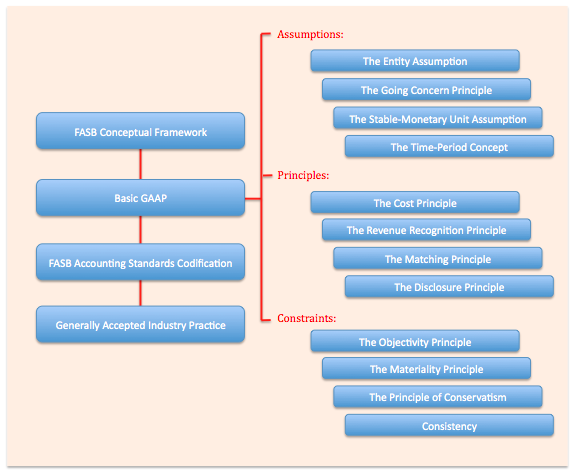

What Are the Generally Accepted Accounting Principles? GAAP covers a wide array of topics such as financial statement presentation, liabilities, assets, equities, revenue and expenses, business combinations To facilitate comparisons, the financial information must follow the generally accepted accounting principles. While the overall GAAP is specified by...

Generally accepted accounting principles

› accounting-principles-iAccounting Principles I - CliffsNotes CliffsNotes study guides are written by real teachers and professors, so no matter what you're studying, CliffsNotes can ease your homework headaches and help you score high on exams. Generally Accepted Accounting Principles (United States) - Wikipedia Generally Accepted Accounting Principles (GAAP or U.S. GAAP, pronounced like "gap") is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC). While the SEC previously stated that it intends to move from U.S. GAAP to the International Financial Reporting... US GAAP: Generally Accepted Accounting Principles Generally Accepted Accounting Principles (GAAP or US GAAP) are a collection of commonly-followed accounting rules and standards for financial Although its principles work to improve the transparency in financial statements, they do not provide any guarantee that a company's financial...

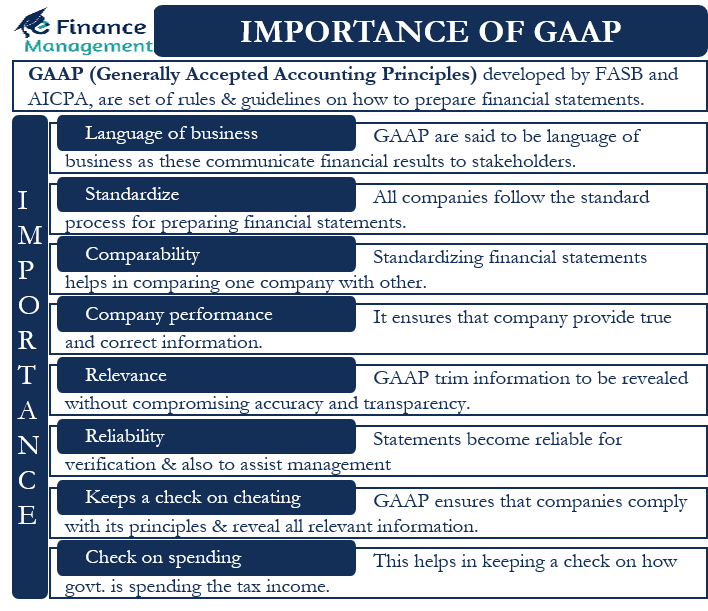

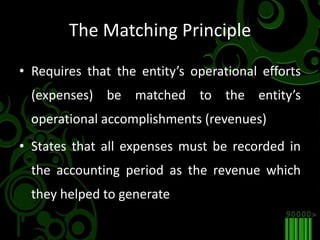

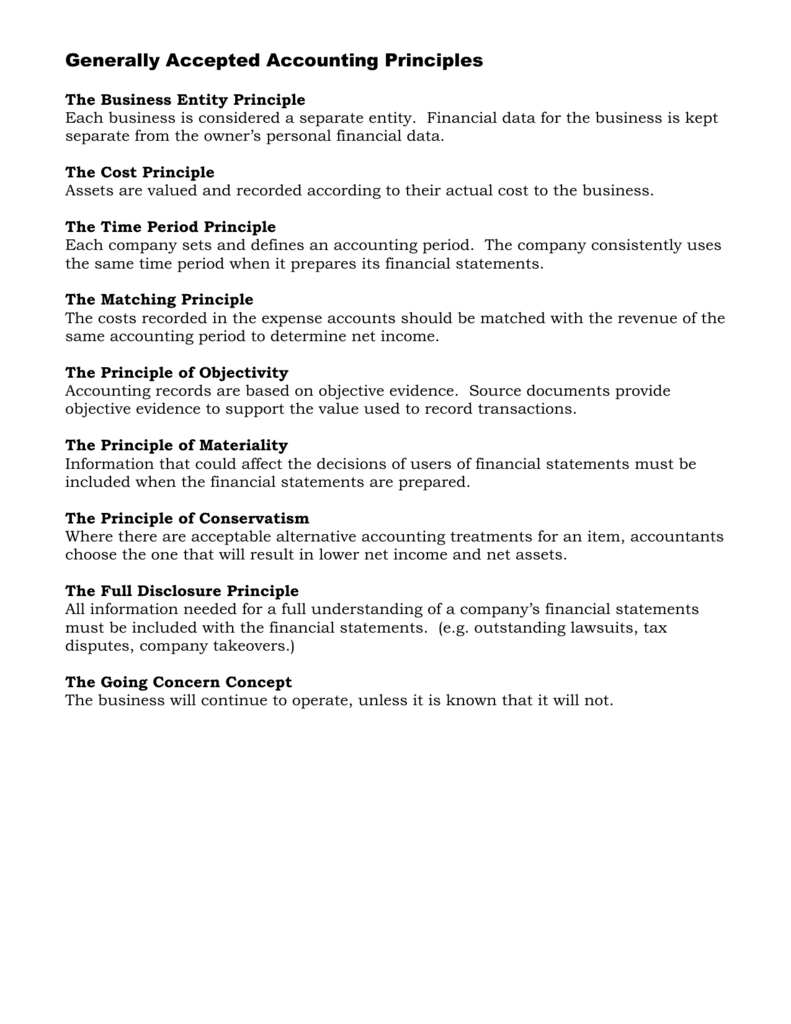

Generally accepted accounting principles. Generally Accepted Accounting Principles (GAAP) GAAP is an amalgamation of authoritative standards and the usually accepted methods of recording and reporting info on accounting. The principles included in GAAP are derived from tradition, like the concept of matching. In any financial report, the auditor/preparer is supposed to indicate the... Unit 4: Generally Accepted Accounting Principles... | Quizlet Generally Accepted Accounting Principles are principles, rules, and standards to be followed in preparing and reporting financial statements which are the primary source of information in financial analysis. Do Generally Accepted Accounting Principles Require... - Chron.com Accrual accounting is required by generally accepted accounting principles for all non-governmental and for-profit entities. The accrual basis of accounting is required for these companies because it is thought to more accurately depict the underlying economics of business transactions. Generally Accepted Accounting Principles (GAAP) Definition GAAP is a common set of generally accepted accounting principles, standards, and procedures that public companies in the U.S. must follow when It consists of a framework for selecting the principles that public accountants should use in preparing financial statements in line with U.S. GAAP.

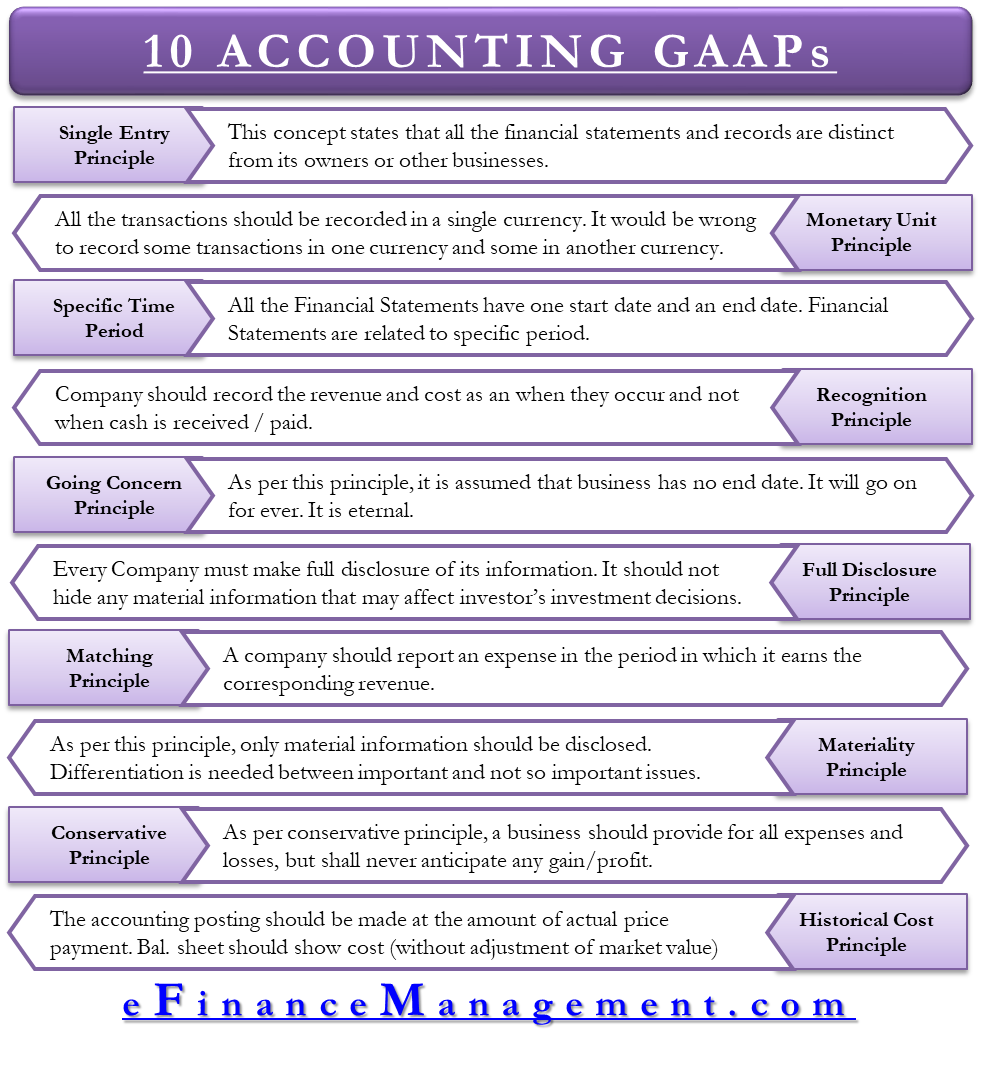

What Are Generally Accepted Accounting Principles? Generally accepted accounting principles (GAAP) are used to prepare and report financial statements. The 10 principles of GAAP pertain to If your company hopes one day to issue stock or participate in mergers and acquisitions, knowledge of generally accepted accounting principles... Generally Accepted Accounting Principles... - Accounting.com Generally accepted accounting principles, or GAAP, are standards that encompass the details, complexities, and legalities of business and corporate accounting. The Financial Accounting Standards Board (FASB) uses GAAP as the foundation for its comprehensive set of approved... Standards The FASB Accounting Standards Codification™ is the single source of authoritative nongovernmental U.S. Generally Accepted Accounting Principles (GAAP). The FASB offers a number of learning resources to help users get the most out of the Codification. >> Accounting Principles | Explanation | AccountingCoach Some of the accounting principles in the Accounting Research Bulletins remain in effect today and are included in the Accounting Standards Codification. Comparability is enhanced by requiring the use of generally accepted accounting principles. Relevance and timeliness.

› m › managerialaccountingManagerial Accounting Definition Oct 08, 2021 · Financial accounting must conform to certain standards, such as generally accepted accounting principles (GAAP). All publicly held companies are required to complete their financial statements in ... Generally Accepted Accounting Principles Accountants use generally accepted accounting principles (GAAP) to guide them in recording and reporting financial information. GAAP comprises a broad set of principles that have been developed by the accounting profession and the Securities and Exchange Commission (SEC). GAAP: What are Generally Accepted Accounting Principles? Since Generally Accepted Accounting Principles is reported in short time intervals like weeks, months, quarters or years, you have more flexibility to identify trends in the data and better project budgets. Planning for the Future. Once you learn GAAP, you may identify trends over time that you... What are the generally accepted accounting principles? - Quora These are the 10 generally accepted accounting principles: 1. Going concern principle- the business will continue its operations for an indeterminate period of time. Accounts are classified as real personal and nominal. Principle for real accounts- Debit what comes in and credit what goes out.

GAAP: Generally Accepted Accounting Principles | CFI GAAP, or Generally Accepted Accounting Principles, is a commonly recognized set of rules and procedures designed to govern corporate accounting and financial reportingSEC FilingsSEC filings are financial statements, periodic reports, and other formal documents that public companies...

What Are Generally Accepted Accounting Principles? GAAP, or generally accepted accounting principles, are a set of benchmarks that cover the intricacies, complexities, and technicalities of corporate accounting. It is a set of guidelines and regulations that businesses must adhere to when submitting financial information.

US GAAP: Generally Accepted Accounting Principles Generally Accepted Accounting Principles (GAAP or US GAAP) are a collection of commonly-followed accounting rules and standards for financial Although its principles work to improve the transparency in financial statements, they do not provide any guarantee that a company's financial...

Generally Accepted Accounting Principles (United States) - Wikipedia Generally Accepted Accounting Principles (GAAP or U.S. GAAP, pronounced like "gap") is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC). While the SEC previously stated that it intends to move from U.S. GAAP to the International Financial Reporting...

› accounting-principles-iAccounting Principles I - CliffsNotes CliffsNotes study guides are written by real teachers and professors, so no matter what you're studying, CliffsNotes can ease your homework headaches and help you score high on exams.

US GAAP Generally Accepted Accounting Principles, US GAAP or simply GAAP are terms for the generally accepted accounting principles and rules used in the.

0 Response to "43 generally accepted accounting principles"

Post a Comment