41 403b vs 401k

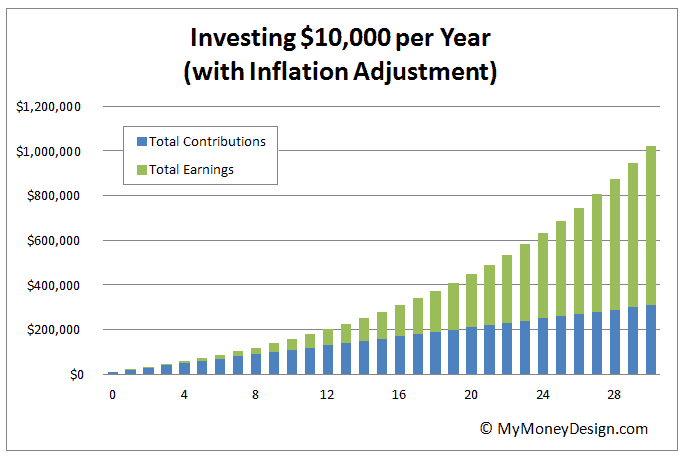

What is the difference between a 403b and 401k? - Quora Both 401(k) and 403(b) are just sections of the Internal Revenue Code. They both allow employees to set aside a portion of their compensation, before 401k plans are offered by businesses large and small. You can get to choose various investments selected by the plan and follow basic investing rules. What's the Difference Between 401(k) and 403(b) Retirement Plans? Investing in your retirement early is the best way to ensure financial stability as you age, especially when it comes to understanding various retirement options. Getting started may feel overwhelming — luckily we're here to help.

401(k) vs. 403(b): What's the difference? - Stash Learn 403(b) vs 401(k) at a glance. 403(b). 401(k). Eligible employers. Educational organizations and nonprofits organized under the 501(c) (3) internal revenue code.

403b vs 401k

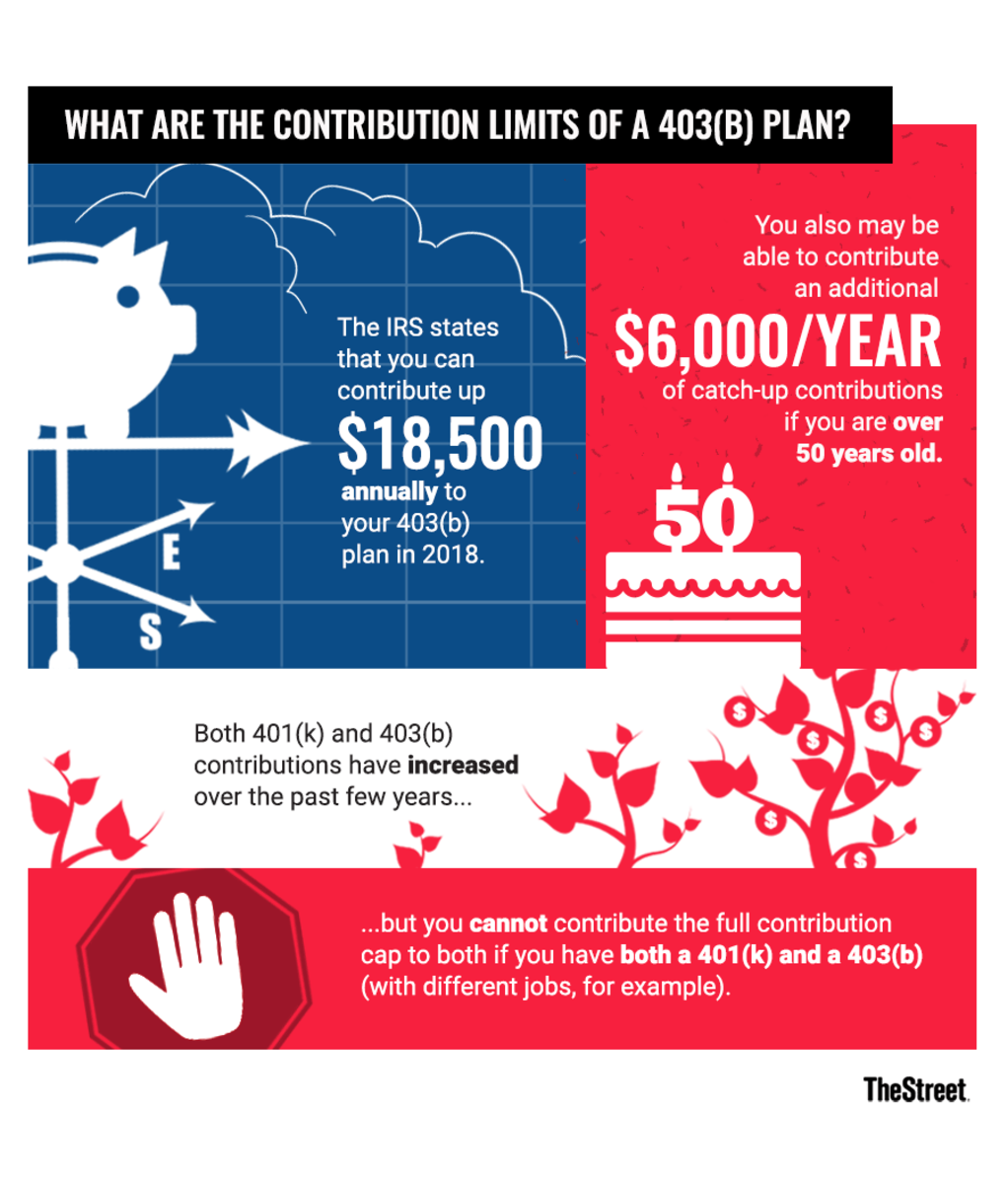

401(k) vs 403(b): Differences In Investments, Compliance, and... Benchmarking 403(b) vs. 401(k). Carefully consider your options, looking at: how much compliance responsibility you'll take on, whether it fits your employees' needs, and if the plan is flexible enough to scale as you grow. Also important is investment selection: Most 403(b) plans only allow annuities and... 403b Vs. 401k: What's The Difference? - Forbes Advisor While 401(k) and 403(b) plans have the same general contribution limits, 403(b) accounts have an edge: Employees who have worked for a qualified Qualifying employees can contribute up to $3,000 per year for up to five years over the federal maximum. 401(k) vs. 403(b): Which Is Better? 403(b) vs. 401(k): What's the Difference? Like a 401(k), you contribute your money prior to paying taxes. This means that you get a tax deduction for contributing now. Realize that access to a 403b might be affected by the hours you work, and there might be vesting requirements. Roth 403(b) vs. Roth IRA.

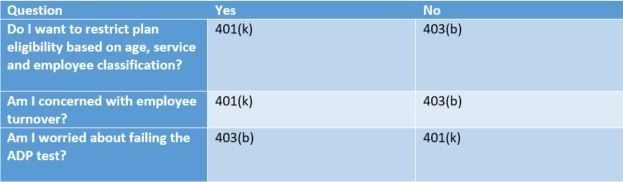

403b vs 401k. Can You Have More Than One 401k? Yes, Here's How! | White ... 21.07.2020 · -403b – I plan on maxing this out-governmental 457 – not contributing to this-pension plan. Employer 3 – self -individual 401k – I plan on maxing out the employer contribution. Between these three employers, I max out a 403b, a 457, and the employer contribution of my individual 401k. I also accrue time concurrently in two pension systems with a reciprocal … Differences between a 401(k) vs. 403(b) plan | Fox Business While 401(k) plans are offered by for-profit companies, 403(b) plans are offered by tax-exempt organizations like schools, ministries, non-profits, and In general, 401(k) plans offer more investment options than 403(b) plans. It's not uncommon to see 401(k) plans that offer a selection of stocks... 403(b) vs. 401(k) Plans for Non-Financial People Both 401(k) and 403(b) plans can impose age and service conditions on employer matching and profit sharing contributions. Testing - Can my high earners While 403(b) plans are subject to a special Universal Availability Rule, they are not subject to the ADP test. This means all of your employees... 403(b) vs. Roth IRA: What’s the Difference? 22.12.2021 · When considering a 403(b) vs. a Roth IRA, you are not limited to opening one or the other. It can be beneficial to have both types of accounts …

What's the Difference Between a 401(k) and a 403(b)? 401(k). 403(b). How They're Similar. Which One is Better? Just Get Started. As with 401(k) plans, contributions to 403(b) plans are tax deductible, employers can also offer matching contributions, and you can even take a loan out against either account, (though some experts advise against this). › resources › file-6878242022 403(b) vs. 401(k) comparison chart 2022 403(b) vs. 401(k) comparison chart Feature 403(b) 401(k) Eligible employer Educational organizations and nonprofi t organizations under 501(c)(3) of the IRC Any employer Eligible employees All employees but may exclude: • Employees who work less than 20 hours per week • Professors on sabbaticals • Certain students 403(b) vs. 401(k): What's the Difference? | The Motley Fool The 401(k) and 403(b) are both tax-advantaged retirement accounts named after different sections of the tax code. While similar in many ways, 403(b)s are offered only to public school employees, certain ministers, and employees of tax-exempt organizations, while 401 401(k) vs. 403(b): The differences. 401(k) Plan: The Complete Guide - Investopedia 05.12.2021 · Traditional 401(k) vs. Roth 401(k) When 401(k) plans became available in 1978, companies and their employees had just one choice: the traditional 401(k). Then, in …

403(b) vs 401(k): Which Plan Retirement Plan is Better? On your first day of your new job, you get handed a stack of papers about the companies retirement plan and you are undoubtedly confused. Don't worry, we've all been there. What are the differences between a 403b vs 401k? Let's find out. 403(b) vs 401(k) - What's the Difference? How Are They the Same? Want to know how a 403(b) vs 401(k) compares? Here's everything you need to know about each aspect to both, and how to use them to your advantage. In this post, I'll go through each aspect of a 403(b) and 401(k). Along the way I'll tell you whether each part is the "same" or "different", and why. 401(k) vs. 403(b): What's the Difference and Which is... - TheStreet Both 401(k) and 403(b) plans are highly useful for Americans trying to sock away some cash for retirement, yet both have important differences and distinctions that set them apart from one another, and that offer ample retirement savings . Differences in Investment Options for 401(k) vs. 403(b). Is a Roth 401(k) or Roth 403(b) Right... | American Century Investments Roth 401(k) vs Traditional 401(k). Whether it's a Roth 403(b) or 401(k), Roth accounts are funded by employees with after-tax dollars. These contributions do not reduce your taxable income like contributions to a traditional 401(k) or 403(b) do, but they provide the potential for long-term benefits.

403(b) vs 401(k): Which Is The Better Plan? (+ Pros And Cons) 403(b) vs 401(k) plans are all good plans. 403(b) vs 401(k) advantage and disadvantage, contribution limits. Instead of assessing a 403(b) vs a 401(k), estimate the plan's investment choices. Basically, the larger the company, the lower the plan fees.

Overwhelmed With Retirement Options? | 403b vs 401k: What's The... 403(b) vs 401(k): What's the difference?Both are the primary wealth building tools in the workplace today but only about half of the work force is taking...

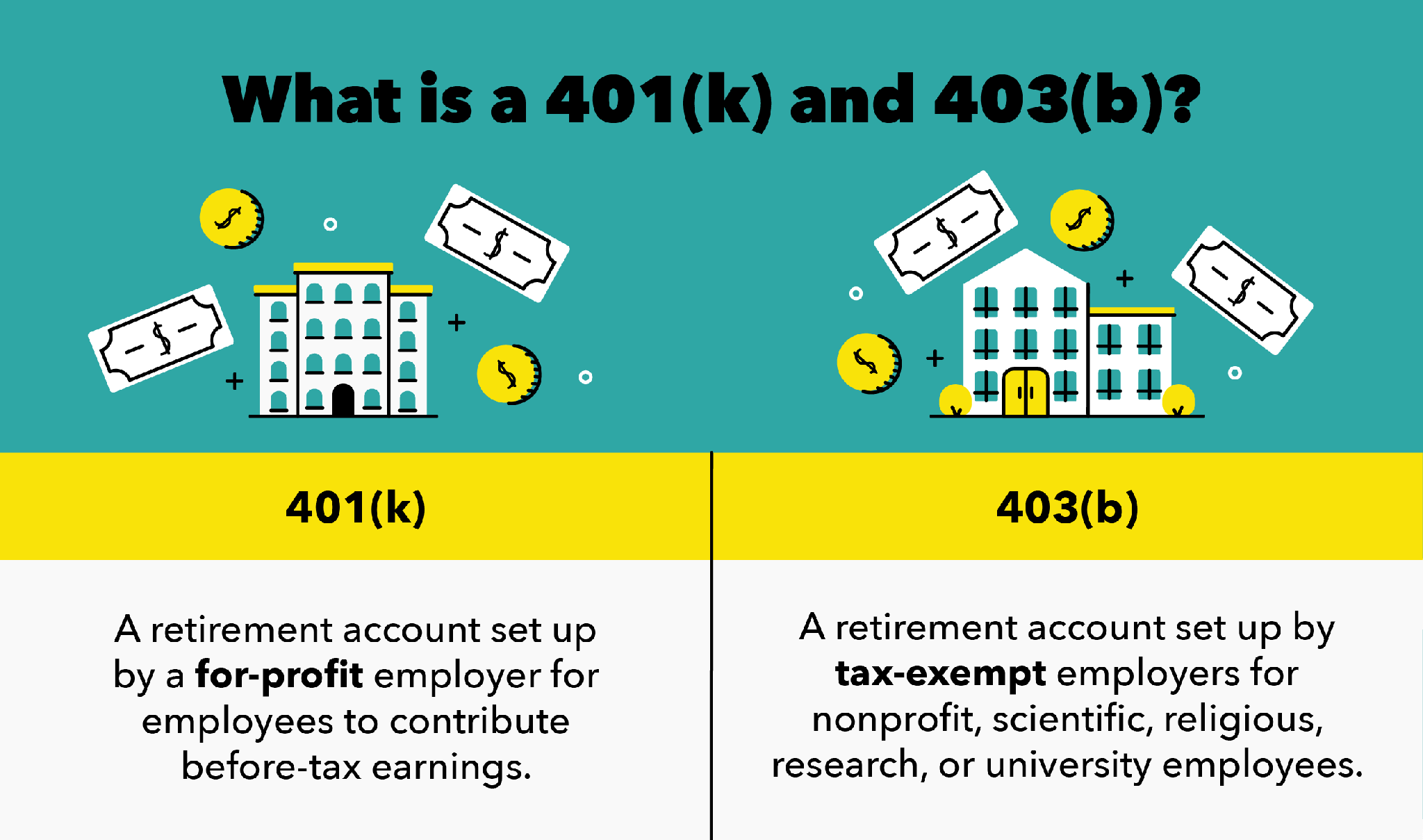

403(b) vs. 401(k): What's the Difference? | RamseySolutions.com Jan 20, 2022 · Eligibility: 401(k) plans are offered by for-profit companies, and 403(b) plans are offered by tax-exempt organizations, such as hospitals, schools, universities, nonprofits and religious organizations. Investment Options: 403(b) plans only offer mutual funds and annuities, but 401(k) plans offer mutual funds, annuities, stocks and bonds. Because 401(k) plans are more expensive for the company, they usually offer a wider range and sometimes better quality of investment options.

403(b) vs 401(k) Accounts: What's the Difference? Dec 19, 2021 · Another difference between a 403 (b) and a 401 (k) is the investment choices. Most 401 (k) plans offer different types of mutual funds as their investment choices, but they can include other investment types. 403 (b) plans can only offer mutual funds and annuities. 3 Technically, 403 (b)s are more limited on investing options than 401 (k)s, but if there is a choice between mutual funds, then a 403 (b) can be nearly as flexible as a 401 (k).

403(b) vs 401(k): Comparing retirement plans for... | Human Interest How to decide: 401(k) vs. 403(b). 401(k) pros: The main benefit of a 401(k) over a 403(b) is flexibility. Would your organization potentially change in Human Interest is an affordable, full-service 401(k) and 403(b) provider that makes it easy for small and medium-sized businesses to help their employees...

403(b) vs. 401(k) vs. 457(b) | John Hancock Retirement 401(k) vs. 403(b) vs. 457(b) comparison chart. The average person changes jobs 12 times throughout their career and spends just over four years at each.1 And with the majority—77%—of full-time workers having access to a retirement plan,2 many people will end their career having participated in several...

403(b) vs. 401(k) - What's the Difference? - SmartAsset Though 401(k) plans and 403(b) plans are similar in many ways, there are a few key differences you should know if you're about to start a new job where one of There are some noteworthy differences between a 403(b) vs. a 401(k). The most important is the types of companies that offer the two plans.

403(b) vs 401(k): Complete Retirement Plans Comparison... Both 401(k) and 403(b) plans are intended to help employees meet long-term objectives, most typically saving and investing for retirement. The plans are set up to allow you to divert some of your pay into an investment account. These withdrawals are usually in the form of payroll-deducted pre-tax contributions.

403(b) Vs. 401(k): Comparison, Pros & Cons, Examples 403(b) and 401(k) plans are two similar options employers provide for retirement savings, but there are key differences between the two. Here is a closer look at how both of these plans work and in which situations you might want to consider enrolling in one. 403(b) vs. 401(k): At a glance.

403(b) Plan vs. 401(k) Plan: What's The Difference? | (Full Guide) Inside Investment Options. The range of investment choices is another big difference between these plan types. A 401k plan often has a much wider range of options like stocks, bonds, index funds, ETF’s, and other choices. However, the options for a 403b are often much more limited.

walletgenius.com › investing › 403b-vs-401k-plans403b vs 401k Plans: What's Better For Retirement - WalletGenius Apr 23, 2021 · The main difference between the two plans is the type of employer sponsoring them. Typically, 401k plans are offered by private, for-profit companies. Meanwhile 403b plans are generally provided by non-profit organizations or government employers. So which plan you have access too probably depends on who you work for.

The Differences Between 401(k) and 403(b) Plans A 401(k) plan is a qualified employer-sponsored retirement plan that eligible employees may make tax-deferred contributions from their salary or wages to Nevertheless, 401(k) plans and 403(b) plans are very similar as far as retirement vehicles go. Both have the same basic contribution limits, both offer...

401(k) vs. 403(b): The Differences | DWC 401(k) or 403(b) : Tomāto, Tomäto? The last few years have brought significant changes to the 403(b) world. The IRS' first update to the regulations in more than 40 years directly imposed new plan document and oversight requirements, and indirectly created renewed focus on the application of...

403b vs. 401k: What's the Difference? - Good Financial Cents The Difference between a 403b and a 401k. Most companies today offer employees a standard 401(k) retirement deferred savings plan. This raises the question of which is better between a 401(k) vs. 403(b). A variety of retirement plans exist today, approved by the Internal Revenue Service as legal...

403(b) vs. 401(k): What's the Difference? Like a 401(k), you contribute your money prior to paying taxes. This means that you get a tax deduction for contributing now. Realize that access to a 403b might be affected by the hours you work, and there might be vesting requirements. Roth 403(b) vs. Roth IRA.

403b Vs. 401k: What's The Difference? - Forbes Advisor While 401(k) and 403(b) plans have the same general contribution limits, 403(b) accounts have an edge: Employees who have worked for a qualified Qualifying employees can contribute up to $3,000 per year for up to five years over the federal maximum. 401(k) vs. 403(b): Which Is Better?

401(k) vs 403(b): Differences In Investments, Compliance, and... Benchmarking 403(b) vs. 401(k). Carefully consider your options, looking at: how much compliance responsibility you'll take on, whether it fits your employees' needs, and if the plan is flexible enough to scale as you grow. Also important is investment selection: Most 403(b) plans only allow annuities and...

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/agreement-and--discussion-1189829021-109d3b8bd8854ad1b0b7b981355d0571.jpg)

0 Response to "41 403b vs 401k"

Post a Comment