39 defined benefit pension plans disappearing

› retirement › social-securityUnderstanding Social Security Benefits - The Motley Fool Dec 02, 2021 · Social Security forms an important part of most people's retirement plans, but the program itself does much more than just that.In a nutshell, Social Security is designed to support disabled and ... mustardseedmoney.com › federal-government-pensionWhat is a Federal Government Pension Worth ... - Mustard Seed ... Jul 31, 2017 · There were quite a few other government employees that were also near retirement. They highlighted how wonderful it was to work for the federal government, namely because of the amazing benefits. They specifically expressed how valuable the pension was, particularly in light of the fact that pensions are disappearing outside of the government.

The Demise of the Defined-Benefit Plan - Investopedia It announced plans in October 2019 to freeze its pension for 20,000 U.S. employees and shift to a defined-contribution plan as steps to help reduce the deficit of its underfunded pension by as much...

Defined benefit pension plans disappearing

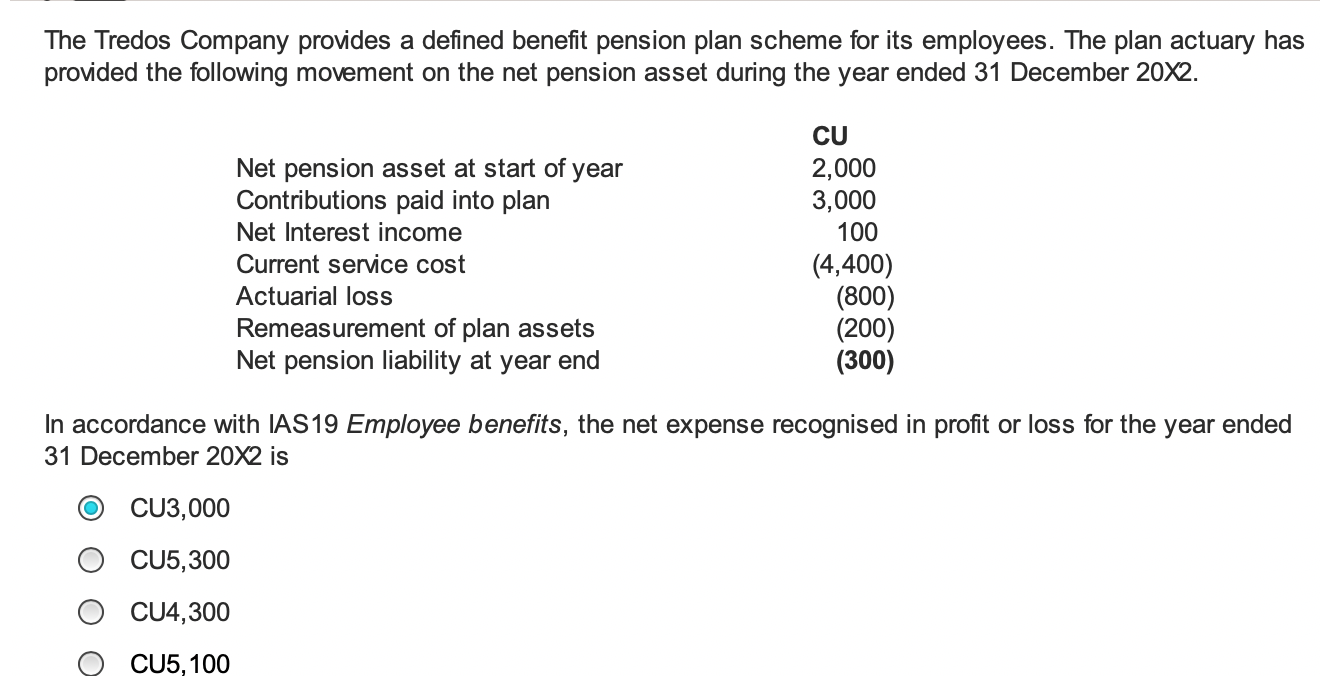

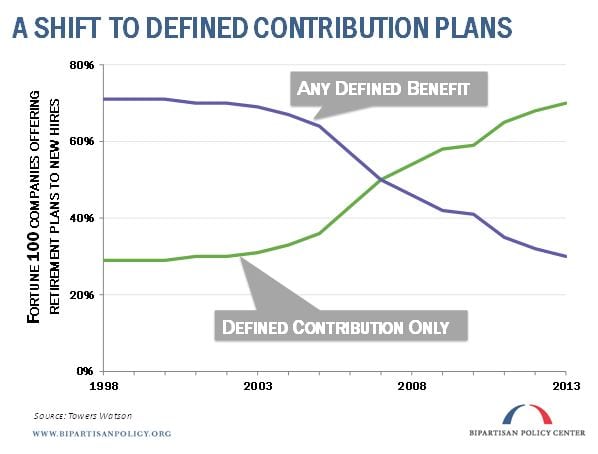

Defined Benefit Plans and the Case of the Disappearing ... Traditional defined benefit plans provide retirees with a guaranteed lifetime pension. However, workers participating in these DB plans have fallen from 38% to 20% between 1980 and 2008. What Does Retirement Shortfall Risk Mean? | Pocketsense Defined Benefit Plans Disappearing. A major cause of the projected retirement shortfall for future retirees is the declining number of workers covered by defined benefit plans, commonly called pensions, that pay a regular income to retirees. The Rise, Fall, and Complexities of the Defined-Benefit Plan Defined-benefit plans have lost ground to defined-contribution plans in recent decades, and their complexities—in particular, estimating pension liabilities—are part of the reason.

Defined benefit pension plans disappearing. What Killed Pensions - Kiplinger There's a litany of stock answers to the question of why private-sector pensions are disappearing. For starters, most workers don't stick with an employer long enough to benefit from a traditional ... › terms › pPension Plan Definition Aug 30, 2021 · Allocated Funding Instrument: A specific type of insurance or annuity contract that pension plans use to purchase retirement benefits incrementally. The allocated funding instrument is funded with ... Defined benefit pension plans disappearing Why are pension plans disappearing? Employers have been dropping pension plans for one simple reason: They are more expensive than 401K's. Retirees receive a specific payment from the company each month, limited only by how long they live, a payment that's not influenced by economic downturns. The company takes on the risk of a market downturn. Will the defined benefit plan disappear? | The Star In Canada's private sector, only one person in five has a workplace pension. Thomas Levy, chief actuary at the Segal Company, doesn't believe the defined benefit pension plan will disappear...

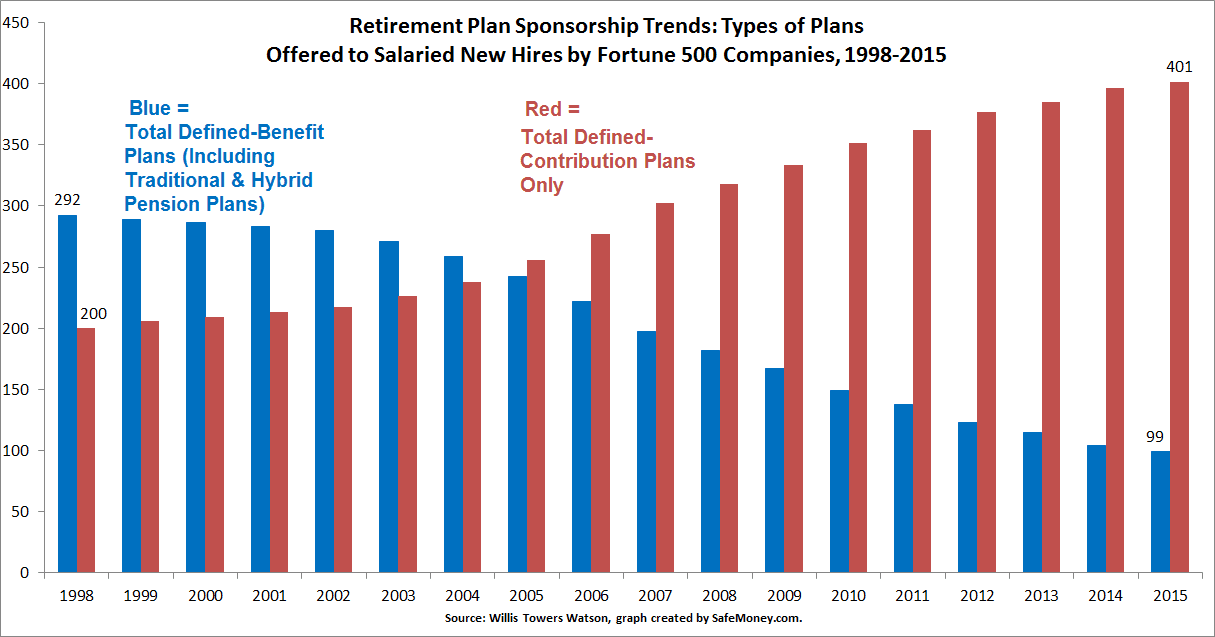

UE News Feature: The Amazing Disappearing Pension - The ... The conversion from traditional defined-benefit plans is devastating the retirement plans of many middle-aged and older workers, with losses of future benefits ranging from 20 to 50 percent. The conversions are occurring just as these workers reach the age where the old formula began to sharply raise the value of their future pension payouts. Defined Benefit Plans Are Disappearing - Global Risk ... Defined-Benefit-Plans-are-disappearing.pdf Traditionally, defined benefit (DB) plans have shielded retirees from the vagaries of the stock market. However, in an effort to de-risk, many private companies and public institutions are moving to defined contribution (DC) plans. PDF The Disappearing Defined Benefit Pension and Its Potential ... The long-term shift in coverage from defined benefit (DB) pensions to defined contribution (DC) plans may accelerate rapidly as more large companies freeze their DB pensions and replace them with new or enhanced DC plans. This paper uses the Model of Income in the Near Term to simulate the impact of an accelerated transition from DB to The disappearing defined benefit pension and its potential ... This article uses a microsimulation model to estimate how freezing all remaining private-sector and one-third of all public-sector defined benefit (DB) pension plans over the next 5 years would affect retirement incomes of baby boomers. If frozen plans were supplemented with new or enhanced defined …

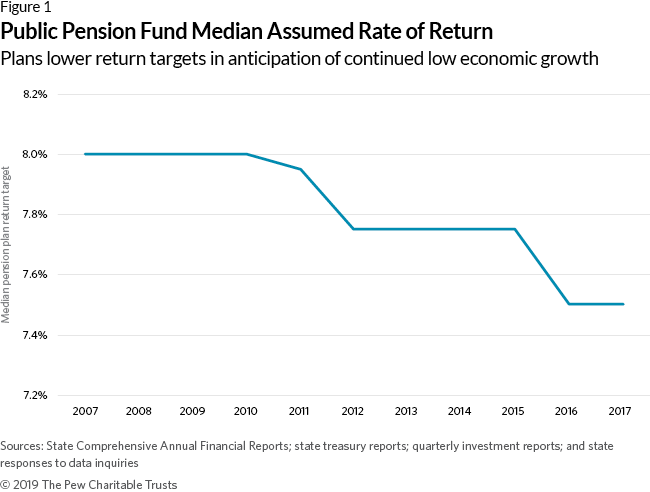

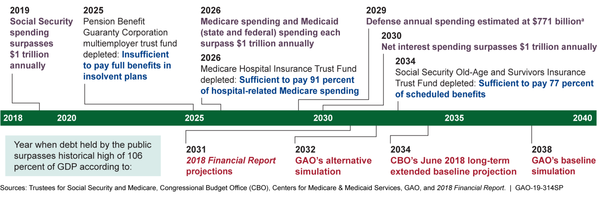

The Disappearing DB Pension Plan - CFO The use of defined benefit pension plans continues to decline as sponsors look to de-risk pension strategies. Gerry Marletta June 28, 2019. Governing a defined benefit (DB) pension plan and its investment strategy has always been challenging. Over the past decade it's also become increasingly complex, not to mention costly, spurring many plan sponsors to reevaluate their pension plan approaches. DB Plans Are Not Totally Disappearing | PLANSPONSOR Data extracted by the Department of Labor's (DOL)'s Employee Benefits Security Administration (EBSA) from 2014 Form 5500 reports finds defined benefit (DB) retirement plans are not disappearing. The total number of retirement plans increased in 2014 to approximately 685,000 plans—a 0.6% increase over 2013. The number of defined contribution (DC) plans grew by 0.5%, while the number of DB plans increased by 1.6%. The data also shows the total amount of assets held by retirement plans ... What really happens when pensions disappear - CNBC Utah was one of many states revising or replacing their retirement plans in the wake of the 2008-09 financial crisis, which decimated many states' pension funds. A 2013 study by Boston College's ... Sotheby's Owner Patrick Drahi To End Employee Pension Plan ... The trust, which has a $9.2 billion endowment, is seeking an insurance company to buy out its pension plan. Doing so would terminate the $336 million plan by the spring, Bloomberg reported. When...

Pensions Are Disappearing, Here's How to Save for ... We generally categorize retirement plans as being one of two types: A defined benefit plan (DB) or a defined contribution plan (DC). If your employer promises to pay you $3,000 per month after you ...

Is a defined benefit plan a pension A defined benefit plan, most often known as a pension, is a retirement account for which your employer ponies up all the money and promises you a set payout when you retire. A defined contribution plan, like a 401(k) or 403(b), requires you to put in your own money.20 мая 2014 г.

The Pension Is Dead — Is the 401(k) Next? | GOBankingRates Starting in the 1980s, pensions rapidly began disappearing, as the defined contribution 401(k) plan dominated. Unlike with pensions, 401(k) plans don't offer guaranteed retirement payouts, which are instead determined by the performance of the 401(k) investments.

The Disappearing Defined Benefit Pension and its Potential ... The long-term shift in coverage from defined benefit (DB) pensions to defined contribution (DC) plans may accelerate rapidly as more large companies freeze their DB pensions and replace them with new or enhanced DC plans.

› what-is-a-pension-and-how-doWhat Is a Pension? - The Balance Jan 25, 2022 · Pension Benefit Guaranty Corporation. "Your Guaranteed Pension: Single-Employer Plans." Accessed Nov. 21, 2021. Social Security Administration. "The Disappearing Defined Benefit Pension and Its Potential Impact on the Retirement Incomes of Baby Boomers." Accessed Nov. 21, 2021. Department of the Treasury.

Retirement plans: Corporate pensions are dying off, Mercer ... By late 2019, the average pension fund had 85% of the funds necessary to meet its obligations over time due largely to low interest rates, according to Mercer's 2020 Defined Benefit Outlook. The...

Trends in Defined Benefit Pension Plans Since the mid-1980s, there has been a shift away from private-sector defined benefit pension plans. The combined number of PBGC-insured single-employer and multiemployer defined benefit pension plans peaked at 114,400 in 1985 but has declined sharply since then to about 32,500 plans in 2002.

› mbachnak › retirement-planning-pptRetirement Planning PPT - SlideShare Jun 25, 2012 · Keogh Plan- A tax deferred pension plan available to self-employed individuals or unincorporated businesses for retirement purposes. A Keogh plan can be set up as either a defined-benefit or defined-contribution plan, although most plans are defined contribution.

› policy › docsSocial Security Retirement Benefits and Private Annuities: A ... The benefit can be calculated based on those factors alone. 18 As employer-sponsored retirement plans continue to shift from DB to DC plans, it is important for individuals and policymakers to understand both the significance of a steady income stream throughout retirement and the pros and cons of the various sources of retirement income.

PDF Research Series NCPERS Meanwhile, vocal opponents of public pensions would like to see defined-benefit (DB) pension plans disappear or be converted into do-it-yourself retirement . savings plans such as 401(k)-type defined-contribution (DC) plans. Attacks from foes of public pensions rest on a weak foundation. They argue that the public pension funding gap is too large.

Pension Plans Continue to Fade Away. Why That ... - Barron's Overall, S&P 500 companies report about $2 trillion in defined-benefit pension obligations, down from a few years ago. Lockheed Martin bought a $1.9 billion insurance annuity covering 20,000...

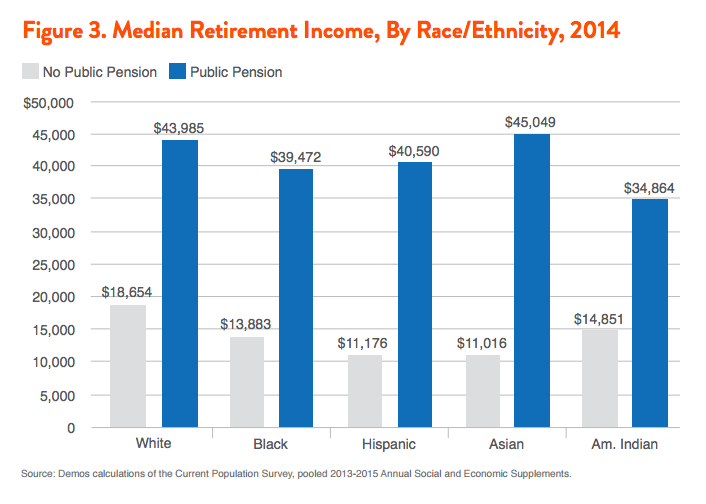

PDF The Disappearing Defined Benefit Pension and Its Potential ... The freezes will reduce average income at age 67 by $700 per person. DB pension benefits will decline by $1,100, but new and enhanced DC plans will raise income from retirement accounts by $300 and delayed retirement will raise earnings at age 67 by another $100. The accelerated decline in DB coverage will produce more losers than winners.

PDF The Vanishing Defined Benefit Pension in Aerospace Insurance premiums set by Congress and paid by sponsors of defined benefit plans - $33 per person /year in 2009* investment income assets from pension plans trusteed by PBGC and recoveries from the companies formerly responsible for the plans • Maximum pension benefits paid in 2009 is ~$ 54,000 @ 65 years old* Less for earlier retirement

Longevity Annuity Contract - QLAC With pension plans disappearing and your health and longevity increasing now is the time to lock in the increased QLAC income payments. Update: June 2019: Retirement is the time you look forward to later in life, the kids are all grown up and now you get the time to do so many of the things you probably put off because of your career.

The Disappearing Defined Benefit Pension and Its Potential ... The Disappearing Defined Benefit Pension and Its Potential Impact on the Retirement ...

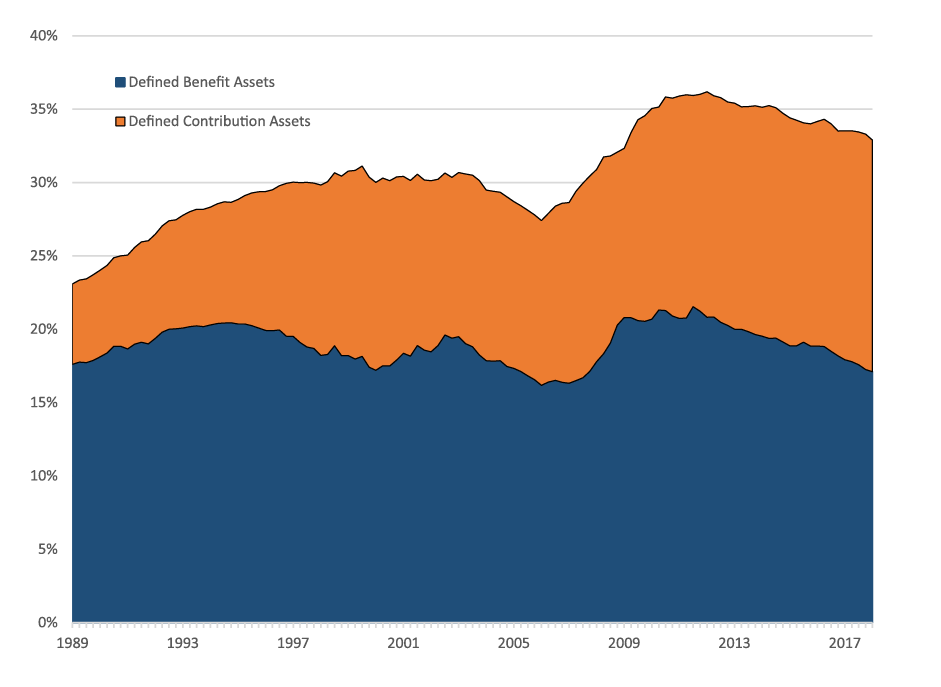

The Fed - Are Disappearing Employer Pensions Contributing ... The disappearance of traditional employer-sponsored DB pension coverage is not the primary cause of this dire situation, however, because the share of employer-sponsored retirement wealth held by the top wealth quartile was already around two thirds in 1989.

Pension Plans Disappearing - CFO Pension Plans Disappearing. A new report suggests that defined benefit pension plans, under pressure on several fronts, are disappearing at an increasing pace. The report, by human resources consulting firm Watson Wyatt, found that the number of Fortune 1000 companies that have frozen or terminated their defined benefit pension plan has risen dramatically in the past two years.

The Rise, Fall, and Complexities of the Defined-Benefit Plan Defined-benefit plans have lost ground to defined-contribution plans in recent decades, and their complexities—in particular, estimating pension liabilities—are part of the reason.

What Does Retirement Shortfall Risk Mean? | Pocketsense Defined Benefit Plans Disappearing. A major cause of the projected retirement shortfall for future retirees is the declining number of workers covered by defined benefit plans, commonly called pensions, that pay a regular income to retirees.

Defined Benefit Plans and the Case of the Disappearing ... Traditional defined benefit plans provide retirees with a guaranteed lifetime pension. However, workers participating in these DB plans have fallen from 38% to 20% between 1980 and 2008.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/Senior_Raedle-56a9a64c3df78cf772a938a3.jpg)

/WorkRetirement-56eeac473df78ce5f8395f69.jpg)

/Balance_What_Is_A_Pension_And_How_Do_You_Get_One_2388766_V2-c977283a02f54f34ac6f31d018585830-ed6f412b721d4dfc85f6cac9184c78ab.jpg)

0 Response to "39 defined benefit pension plans disappearing"

Post a Comment